Herman Degener, Digital Media Strategist at The MediaShop, writes that according to eMarketer research, 83% of internet users in South Africa watch broadcast TV, and 81% of the same audience watch Subscription Video On Demand (SVOD) such as Netflix.

Time shifted viewing continues to become a regular characteristic amongst TV audiences in South Africa, with the majority of internet users having recorded shows in the past month, and almost three quarters of us having made use of services like DSTV’s Catch Up (on demand) feature. This all confirms that TV isn’t going anywhere soon, and why should it?

The Sun Always Shines on TV by Norwegian trio A-ha released in 1985 was a great tune for us Gen X’s, and for Millennials too. It was around about the time when the advertising mad men were enjoying the heights of their chosen professions and probably even made cameo appearances in the good ol’ Peter Stuyvesant ads, or at least lived the lifestyle the brand was selling.

TV was big back then. Fast forward almost four decades later and it’s still big, literally and figuratively. TV has the somewhat dubious pleasure of being placed in the category of traditional media, at risk of being usurped by all things digital and online. Yet it has managed to keep pace with its online counterparts and remain as relevant today as it was back when Morten was serenading mannequins.

Many households in South Africa feature a large format TV screen nowadays; not all are Smart (only around 39% of internet users own a Smart TV) however with the leap to DTT (Digital Terrestrial Television) now having transpired, we can expect many more South Africans to start enjoying their home telly in ways they never imagined. It’ll be a small hop into fully digital compatible TV world for them too given the proliferation of gadgets to turn a ‘dumb’ TV into a Smart TV and the ever-increasing spread, and therefore access to a reliable internet connection.

So, what does this mean for the future of TV, not just in South Africa but globally? Well, you may have heard of the term Connected TV (CTV), which in layman’s terms is simply any TV that is connected to the internet (either directly or via a device such as Apple TV) and uses that connection to stream content, such as YouTube for example (yes, many South Africans are now enjoying YouTube on their TV screens, not only their mobile phone or tablet). Like most things digital media related, there are many acronyms in the CTV space, however for now I would just like to highlight two of them: SVOD and Ad Supported Video on Demand (AVOD).

SVOD is something many South Africans are coming to terms with, where you pay a monthly fee to access TV shows, series, movies and sports. Examples are Showmax, Netflix, Amazon Prime and now available in SA, Disney+.

AVOD is, incidentally, also a concept we’re all too familiar with, think YouTube. Unless you’re a YouTube Premium subscriber (which then puts you in the SVOD category) then you’re using an ad-supported video on demand service. Other examples of AVOD services are hulu (owned by Disney), Peacock (owned by NBC), tubi (owned by FOX) and Roku (owned by Roku).

OK, so now that you have an idea of the CTV landscape it’s important that we look at trends, as they are what’s going to help brands prepare for the future of TV advertising. SVOD is nascent in South Africa (when compared to some international audiences) however I’m not sure it’ll even peak before AVOD services start to pour into South Africa and audiences flock there instead.

There are a couple of reasons for this:

Subscription fatigue: content proliferation drives subscription fatigue; too many SVOD services and only so much share of pocket. With many networks starting to take their owned content in-house (think Friends on Netflix US being taken back by Warner Bros (HBO), or The Office being taken back by NBC (Peacock), there will be more and more SVOD options coming into South Africa. At some point the consumer reaches their affordability limit and switching between SVOD services will seem too admin intensive, so they’ll either keep what they have or ditch the lot.

Economics: to the point around share of pocket above, our gini coefficient in South Africa automatically caps the growth of SVOD, it’s simply not scalable here. This all makes our market extremely fertile ground for AVOD services to flourish. Whichever way we look at Connected TV, whether from a SVOD or AVOD perspective, there are some real benefits to marketers who want to leverage the opportunity and ready themselves for when we tick passed the ‘early adopters’ phase in the technology adoption curve.

Benefits of CTV advertising:

Incremental Reach: As viewership shifts toward CTV, it’s becoming increasingly difficult for brands to reach their targets solely through traditional TV advertising. Thus, an early use case has become driving incremental reach. Brands also can flip the order around and adopt a ‘VOD (video-on-demand) first’ strategy.

First Party Data: CTV and addressable advertising* runs primarily on first-party data. Although there is no universal ID solution, each component of the ecosystem contains some first-party data. Streaming platforms inherently require a log-in, as does opting-in to a Smart TV or device, as does having a DSTV subscription.

Enhanced Targeting: CTV moves targeting away from big bucket demographics to being able to target much more granularly using addressability, or by targeting custom audiences at scale. Because of first-party data, it also sidesteps many privacy concerns.

Transactional options: CTV’s internet connectivity makes it possible for advertising to be transactional, and brands can take advantage of innovations such as using a QR code during second-screening behaviour (which has become common place in South Africa).

Small brand friendly: CTV and addressable advertising will enable challenger brands in South Africa to also play in the TV area. Whilst the CPMs will be higher for smaller targets, the overall price point for reaching narrower targets will make TV affordable for smaller budget brands.

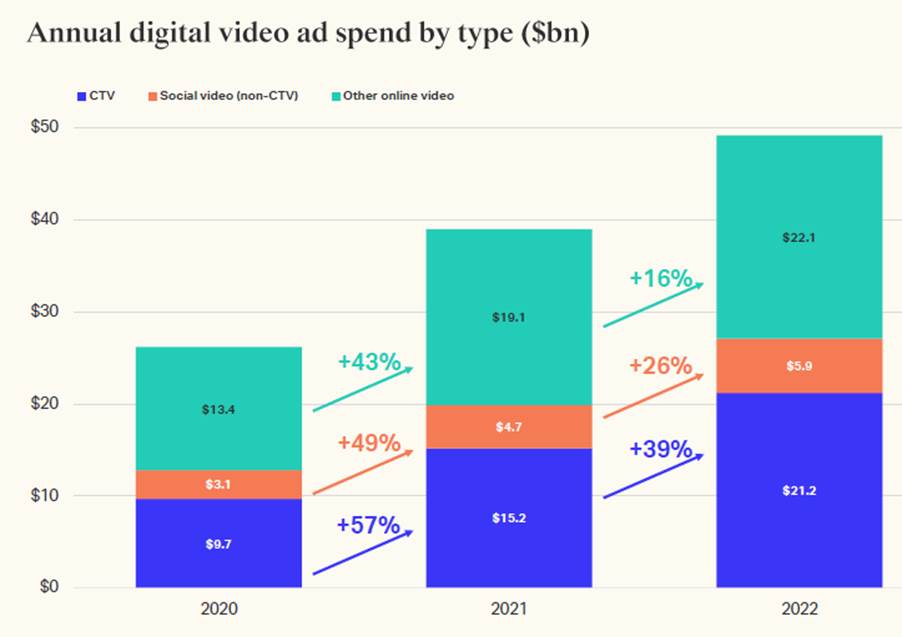

The numbers don’t lie. Although much of what I have written in this blog post relates to what’s happening in the US, we’d be naïve to think the South African TV market won’t follow a similar trajectory. So when we look at the YOY increases in ad-spend going to CTV in the US, we can deduce that local advertisers will follow suit.

No universal ID solution

Here’s a little hypothesis: With all the talk around ‘The Great Resignation’ and ‘The Great Reinvention’, it’s time for ‘The Great Rebundling’! Given there isn’t a universal ID solution (i.e. one login to access TV content from multiple networks/publishers) it would be superb for both the end user and advertisers if an aggregator came along and offered access to all premium (and non-premium) content for a fixed monthly fee. Think Spotify or Apple Music, a one-stop-shop for all your movies, series, documentaries and maybe even sport as well. As the song goes, the sun (will) always shine on TV.

*Addressable advertising is TV advertising targeted based on data and segmentation, rather than large demographic buckets. Mostly used to describe ads served via set-top box (such as DSTV or DTT) to linear TV, it also encompasses CTV advertising.

THE MEDIASHOP

www.mediashop.co.za