Shopping malls must innovate, reinvent their spaces and connect with shoppers in ever deeper ways if they want to avoid becoming casualties of technology and the internet, as consumers increasingly seek out greater shopping convenience.

This is the view of technology experts such as tour guide to the future, Pieter Geldenhuys, of the Institute for Technology, Strategy and Innovation who works closely with the London Business School and The Fuqua School of Business at Duke University in North Carolina.

Imagine it is the festive season shopping frenzy and you are sitting comfortably, sipping on a steamy latte and shopping up a storm on your tablet at your favourite local restaurant, inside your favourite shopping mall.

Fortunately, although the rest of the mall is in the throngs of festive shopping chaos, here you are, shopping quietly while you dine, comparing prices, choosing your goods and clicking ‘pay’. The goods, some of them discounted because you used the mall app to shop, will be delivered to your home or be ready for you to collect immediately after your leisurely lunch.

Sounds too good to be true? Well, not exactly. Especially if shopping malls want to ensure they survive and thrive as the coming tsunami of technological advances, dubbed Industry 4.0, sweeps across every area of commerce, from the factory floor to point of sales.

Geldenhuys paints both a thrilling and daunting picture for shopping malls, faced with the option of either embracing technology and all it can offer to connect with consumers in ever deeper ways, or turning away and later facing the reality of a total metamorphosis and even closure.

The primary purpose of a mall was to make it easier for individuals to find goods under one roof, it was a convenient culture, and everyone went there. But now a number of these products are available on the Internet where the cost of an online store is now cheaper than a traditional store. Even if there is a 20% drop in spending in a mall, it can take it into a negative space.

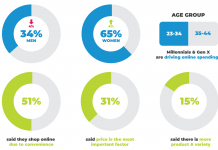

When South African consumers shop online, the most popular goods that are browsed to compare for price and convenient delivery include computers and electronic goods. Small technological items are not favoured in malls but this does not mean the mall is dying. However, we have to realise online shopping will have an impact on malls.

Most at risk of facing redundancy are middle-sized malls, he says, while mega-malls with large entertainment complexes, offering consumer experiences and small local malls that house pharmacies and supermarkets, are most likely to continue thriving. Malls should make shopping convenient, similar to the online experience. For example, if a consumer goes to a mall and a store doesn’t have the shoe size, can they deliver it to the consumer’s house from another store?

But apart from the threat of online shopping, malls need to embrace technology to drive brands and to retain and attract consumers. Face recognition technology, he says, can be used to recognise consumers via CCTV cameras as they step into a mall. Based on a person’s digital twin – which reflects their online behaviour patterns – personalised adverts can be directly marketed to the consumer via the mall’s app on their mobile phone. For example, an outdoor or sporty person can be targeted with special discounts on camping equipment and sports gear.

Artificial Intelligence helps us learn the patterns of behaviour, such as how changes in the weather leads to changes in spending patterns. For example, when it rains, we sell more pancakes. Machine learning is uncovering society’s hidden complex patterns.

We are aware that everything done on a smartphone and the Internet leaves a digital footprint. We need to be aware of inherent patterns hidden in social interaction. And malls need to look at the digital twin to understand core customer needs and what will attract different personality types.

The question is how do we create new ideas to drive experimentation and identify the type of people coming into our malls? Some malls are more laid-back, some more hi-tech. Discover the archetype of your customer base and then use commercial tools to create a personality or brand archetypes around your mall and attract those personalities.

Malls need to reinvent themselves to become entertainment destinations if they are to survive and thrive in future. Malls and tenants also need to share data and a common vision to improve their chances of survival. Geldenhuys believes the USA provides useful lessons. If we follow what the US has done, we might see some malls literally shutting down and some online stores might use these malls as a retail space.

Futurist Doug Stephens of the Canadian based retail industry consultancy, Retail Prophet said, ‘If we go back 30 years, the first stop for the typical shopper…was in many cases the shopping centre, which was like an analogue version of the Internet with organised and catalogued brands. But today that fundamental truth is no longer. Consumers are not turning to the local mall, they are going online.’

When consumers in North America decide they need something, 66% of them first go online and Amazon has become the default search engine for shopping. There are some exceptions. Shopping centres in the Middle East are doing well because of the environment – people need shopping centres to escape the heat. The object of shopping centres is to create an environment where consumers can spend their time wisely. There will be a transition whereby the shopping centre evolves into more of an entertainment and lifestyle centre as opposed to a retail shopping centre.

In the US some 28 major retailers are currently facing bankruptcy and Stephens believes the days of malls with hundreds of retail stores are numbered. We are going to see the percentage of retailers in shopping centres decline. Most brands, retailers and shops in the high street were constructed before the Internet, well before 1995. In a post Internet world, do we need shopping centres with 409 stores?

Retail stores which comprise around 70% of mall space, could in future decline to 30% as malls transition to offering more entertainment and experiences to consumers. A thousand years ago the primary meeting place for information and to socialise, was the market in the centre of a town or city. In the modern age, we still need to socialise and connect.

It is debatable whether we need it the way it is. One hundred years from now we are still going to want and need community spaces, but they are going to be very different places – we simply don’t need as many shopping centres. But Stephens believes the malls that will survive can turn over greater profits in future by tweaking their business models.

Traditionally, brands have gone to the marketplace and bought media to drive people to retail distribution but the shift that is important for brands to understand, especially in SA which is in the early days, is that media is becoming the store.

When consumers consider a purchase, the first step is connecting with media like a smartphone, laptop or Instagram. But it’s important to remember that the corollary is also true. Stores are becoming media and very powerful media when they get it right.

Future shopping malls should be viewed as media channels that can capitalise on their millions of consumer visits every year. In SA, online rental is growing at 15% per year, which means there has to be some correlating decline in physical retail. And if we continue to drive revenue on square metres, we have declining value. But if we look at stores as a media property and value it, then you can make more money.

Only time will tell how the survival game pans out. But, considering the opinions of many analysts, malls need to evolve with the exponential development of technology-driven markets.

This article was sourced from www.sacsc.co.za