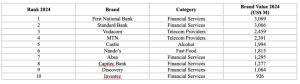

First National Bank is South Africa’s number one brand worth over $3.1 billion. It has grown both its retail and private banking client base; with a new pricing structure and ongoing innovation to enable convenient access to its services via award-winning digital banking channels and mobile applications. Customers trust the bank to be acting in their best interests.

South Africa’s most valuable brands have a total combined value of $29.7 billion, as published in the Kantar BrandZ Most Valuable South African Brands 2024 Report. In a challenging economic landscape, Banking, Telecoms and Alcohol brands dominate with their ability to deliver on key drivers for growth.

Following closely in second place is Standard Bank, which increased its brand value by 2%.

Telecom Providers continued their dominance. This year Vodacom ($2.46bn) rose one place to number 3, with MTN ($2.39bn) coming in at number 4. Vodacom benefitted from acquisition, expansion of its network and a focus on enhanced customer experience. The result is a customer ecosystem that delivers offerings including telecoms, fixed connectivity, finance and insurance services.

Once again, South African brands find themselves operating in difficult financial circumstances and the overall value of the Top 30 declined 6%. High inflation and rising interest rates are leading to reduced consumer spend, while the power crisis that results in loadshedding limits the hours that companies can operate and generate growth. The fluctuating value of the South African rand is another contributing factor. Between 2018-2024, the rand has depreciated by around 35%, while the Top 30 South African brands have held their value significantly better than this.

But against this backdrop, 40% of the brands in the ranking grew their value, with Financial Services and Alcohol brands the big story here. Alcohol brand Castle (number 5; $1.99bn), a consistent presence in the Top 30, rounds off the Top 5, achieving the same position as last year.

Kantar BrandZ Top 10 Most Valuable South African Brands 2024

Banking and wealth management group Investec (number 10; $926m) was the fastest riser, growing 33% thanks to its strong leadership, increased UK shareholding and ability to deliver a consistent brand experience.

Insurance brand OUTsurance (number 26; $343m) saw an increase of 26% in brand value through its commitment to providing customers with great value and a diversified service offering. The third fastest riser, insurance, investments and financial planning provider Sanlam (number 15; $697m) also extended its offering to grow 21%.

Ivan Moroke, CEO, South Africa, Insights Division, Kantar, commented: ‘Across a range of business sectors, South African brands are continuing to transcend the currently challenging market conditions. A large proportion are meeting the needs of customers with actions and initiatives that mark them out as being Meaningfully Different and relevant to consumers’ lives today. These strong, forward-focused brands are proving that they can identify what it takes to grow and follow up by implementing programmes to deliver this.’

Beyond Beer

Cider giants Savanna (number 18; $547m) and Hunter’s (number 28; $313m) both entered the Top 30 for the first time on the back of the acquisition of their parent company by Heineken, plus strong brand equity.

Fruit-flavoured beer, Flying Fish (number 16; $618m) grew 12% to become the fifth fastest-growing South African brand.

When it comes to the success of Alcohol brands, while consumption for both Flavoured Alcoholic Beverages (FABs) or Ready to Drink (RTDs) and beer are declining, FABs and RTDs are showing more resilience. Brutal Fruit grew 15% to reach a brand value of $480m, an increase that saw it take the position of fourth highest riser and move five places up the ranking to number 20. Its innovations continue with new flavour Litchi Séche, a female pop-up bar, SheBeen, and an augmented reality experience to provide visually immersive information.

Successful Brands Are Meaningfully Different

These success stories demonstrate that strong brands are resilient. Not only do they weather challenging financial environments, but they can also grow if they are able to be Meaningfully Different to more people. 60% of the brands in the ranking are Meaningfully Different, with experience and exposure being major contributors. Overall, South African brands are ahead of their counterparts in Canada, Europe and Latin America when it comes to Meaningful Difference.

Retail and pharmacy chain Clicks, up one place to number 21 with a brand value of $471m, wins here by providing customers with a consistent store experience regardless of location. Capitec Bank (number 8; $1.28bn), which continues to invest significantly in both its online and offline presence to make life easy for customers, is another brand that scores highly on being Meaningfully Different. Health focused Financial Services brand Discovery (number 9; $1.06bn), and FNB are also strong contenders.

Building Strong Brands

Kantar’s new Blueprint for Brand Growth is designed to help businesses build profitable, strong and sustainable brands in recognition that being Meaningfully Different to more people is a key driver for growth. The evidence-based decision-making framework combines input from Kantar’s experts, industry leaders and advanced analytics that use Kantar’s unique BrandZ and Worldpanel data assets. Deploying this insight, marketers can better control the factors that shape the future of their brands and ensure that they consistently build in the necessary growth accelerators.

Other key highlights from the Kantar BrandZ Most Valuable South African Brands Report include:

Financial Services play a valuable role: 45% of the value of the Top 30 South African brands ranking is contributed by Financial Services, with banking (35%) and insurance (10%) both growing

Sustainability is key: 68% of South African consumers are prepared to invest time and money in brands that try to do good. Sustainability continues to be a growing driver of demand power and brand value, yet too few brands are fully activating the opportunities in the space. Among the top performers, Vodacom championed ‘protecting the planet’ with its renewable energy initiatives, Savanna campaigned around climate change in its own distinctive style, and sustainability stalwart Woolworths (number 11; $919m) continued to make strides in its Good Business Journey.

Expanding beyond national borders: South African brands continue to play on the international stage. Fast food chain Nando’s ranked at number 6 with a brand value of $1.8bn – flying the flag high globally; and Brutal Fruit Cider launched in the UK in May this year.

Brand love matters: despite household budgets being constrained, people will pay more for a well-loved brand. Kantar’s Mzansi Consumer Barometer data puts this at almost a quarter of consumers. This has enabled brands such as Clicks, Checkers (number 17; $580m) and Woolworths to keep justifying their prices, despite consumers viewing them as more expensive than last year.

Special Awards

Clicks has been awarded the 2024 Kantar BrandZ Most Meaningfully Different Brand. Savanna was recognised for Most Memorable Advertising. Capitec Bank was seen to be best at Capturing Market Share; OUTsurance was recognised for Great Value; and Vodacom is the top brand Finding New Space in which to operate.

The Kantar BrandZ Most Valuable South African Brands ranking, report and extensive analysis are available here.

KANTAR

kantar.com