Financial influencers, or fin-fluencers, have gained popularity among Gen Z, with 39% of this generation following them for financial advice. The pandemic highlighted the importance of budgeting and building emergency savings, and interest in financial planning and investing has increased across generations, with 73% of Gen Z’s indicating increased interest in the past two years.

Unlike earlier generations, who relied on more traditional sources for financial education and advice, Zoomers can gain a level of financial literacy at a younger age from social media platforms like TikTok — also known as ‘FinTok’ or ‘StockTok’ (source).

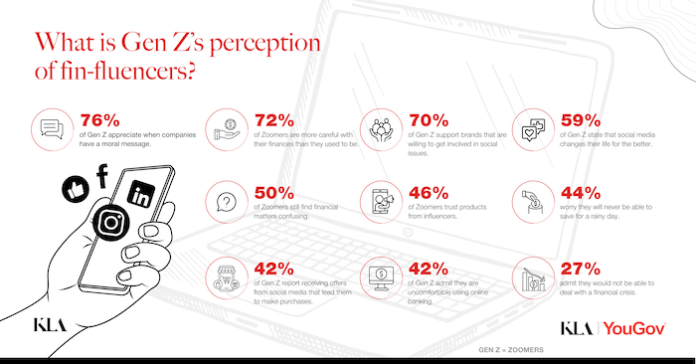

This increased engagement with financial content on social media reflects a larger trend. According to KLA’s YouGov Profiles data, 59% of Gen Z individuals state that social media improves their lives, and 42% report receiving offers from social media that have led to purchases. These statistics highlight the significant influence these platforms have on their financial decisions.

Recognising the influence of fin-fluencers, brands have begun to engage with this generation using these channels. For example, Nedbank’s ChowTown campaign integrated influencers into a 360-degree marketing strategy. Nedbank was able to achieve over 100,000 game plays within three months, demonstrating how financial institutions can leverage influencer marketing to combat financial illiteracy. This approach resonates deeply with Gen Z, who expect brands to support them in building financial resilience.

KLA’s YouGov Profiles shows that 46% of Zoomers trust products from influencers, a notable increase from the 37% reported in 2023, showing a growing positive perception of influencers among this generation.

The data also shows that 76% of Gen Z appreciate it when companies have a moral message, and 70% support brands that are willing to get involved in social issues, highlighting the importance of authenticity and ethical branding when targeting this demographic.

Despite their reliance on social media, Gen Z is not naïve about the pitfalls when it comes to receiving financial advice using this platform. Profiles data shows that 64% of Gen Z distrust how companies use their data, and 42% admit they are uncomfortable using online banking, showing the need for trustworthy digital financial tools.

Zoomers are critical of the ‘picture-perfect’ mentality that dominates social media and are actively searching for authenticity. This is also reflected in their choice of influencers, with 48% of Gen Z following influencers they can relate to on a personal level (source).

While the rise of fin-fluencers provides Gen Z with relatable and accessible financial guidance, it’s important to note that according to KLA’s YouGov Profiles data, nearly 50% of Zoomers still find financial matters confusing; 44% worry they won’t be able to save for a rainy day, and 27% admit they would not be able to deal with a financial crisis.

The data also shows the positive impact of fin-fluencers: 72% of Zoomers say they’re more careful with their finances than they used to be. This shift towards greater financial responsibility suggests that, with the right support from brands and credible influencers, Gen Z could build the financial resilience they seek.

As South Africa’s Gen Z navigates the complex landscape of financial literacy, the role of fin-fluencers is becoming increasingly significant, and brands and financial institutions that can provide genuine and trustworthy guidance could find themselves in a strong position to connect with this generation.

KLA

www.kla.co.za